2025 Ford Ranger Trims, Engines and Body Styles Explained

In much the same way the Ford Transit Custom dominates the van sales charts, the Ford Ranger is the undisputed ‘King of the Pick-up Trucks’ – so which is best for you?

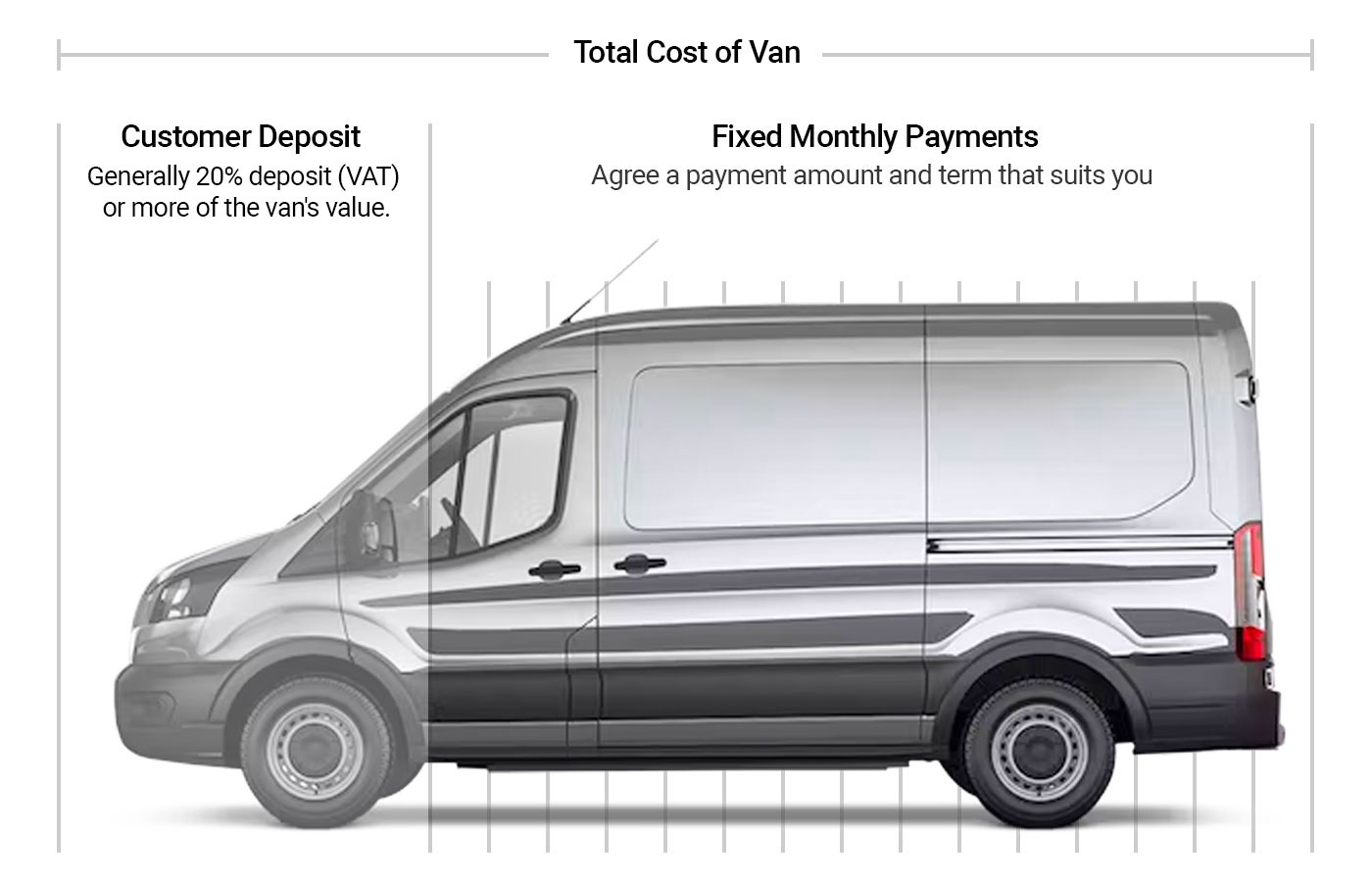

Hire Purchase is a great way to finance your next new van. It's an easy way to buy a new or used van, by breaking the purchasing cost into monthly payments.

Hire Purchase is a great way to finance your next new van. It's an easy way to buy a new or used van, by breaking the purchasing cost into monthly payments.

At the end of the agreement, you will gain ownership of the van. It's important to note that you are not the legal owner of the vehicle until you have made the last payment.

At the beginning of the contract, you are expected to pay a deposit for your new van. The deposit is generally 20% (VAT) or more of the van's value. You can also choose the term of your agreement. This is usually from two to five years.

Note that you can offset the 20% deposit (VAT) against your next VAT return.

During the contract period, you will make affordable monthly instalments until the end of the contract. When you have made the last payment, you are the owner of the van.

Your annual percentage rate will vary depending on the vehicle as well as your credit score. This is why it's important to keep your credit score as high as possible.

If you have a good credit score, Hire Purchase is a great way to buy your next new van. It offers a flexible way to pay off the value of the vehicle, while gaining ownership at the end of the agreement. You can also budget more easily with manageable, fixed monthly payments.

However, if your credit score is less than good, we also offer other finance options. Suitable for all budgets and needs, you can browse our Van Leasing, Van Contract Hire, and Van Fleet Leasing finance offers. To read more about all our finance options, visit our van finance page.

To be eligible for a new van Hire Purchase offer, you must have a good credit score. We will conduct a credit check on all applicants. You must also have proof of the following:

If you are unsure whether you can apply, get in touch with our Vansdirect team. We are happy to help you find the right finance option for you.

Not keen to own a van and want to drive a new van model every few of years? Van Contract Hire may be the right van finance option for you. It allows you to pay monthly rentals in exchange for use of the van. At the end of the agreement, you simply return the van back to the lender.

Learn more

Van Leasing is ideal for those looking for flexibility. You will pay an initial rental at the start of the contract, which is often a minimum of three monthly rentals. During the van leasing agreement, you continue paying monthly rental payments. When your van leasing contract ends, you sell the van to cover the final balloon payment, keeping the majority of any additional proceeds from the sale.

Learn moreWe offer FREE delivery in as little as 5 days, so no long lead times.

We offer truly independent advice ensuring you get the best deal for you and your business.

With transparent pricing, you don't have to worry about unforeseen expenses.

We must be doing something right - read our reviews.

With fixed monthly instalments, you can budget more easily. A new Van Hire Purchase deal is a flexible way to buy a new van, without having to take too much cash out of your business at once. You can also offset the 20% deposit (VAT) with your next VAT return.

New Van Hire Purchase is a great finance option for businesses looking to budget easily. With manageable monthly payments, you can adjust your deposit to an amount that suits you.

With new Van Hire Purchase, you are financing the full value of the van, minus the deposit, to get ownership at the end of the contract. With new Van Contract Hire, you are simply renting the van throughout the agreement, but must hand it back in the end.

There isn't a specific score that you must achieve to be approved for new Van Hire Purchase finance. The higher your score, the more likely you are to be approved for finance. Generally, if your credit score is good or higher, you should have no problem being accepted.

There's an option to choose a new Van Hire Purchase deal with or without balloon payment. If you decide to choose the option with a balloon payment, you are expected to pay a larger sum at the end of the contract to gain the ownership of the van.

The Van Hire Purchase deal with a balloon payment may be the right option for you if you wish to keep the monthly payments as low as possible. However, if you want lower monthly instalments, you must make the final balloon payment before you gain legal ownership of the van.

In much the same way the Ford Transit Custom dominates the van sales charts, the Ford Ranger is the undisputed ‘King of the Pick-up Trucks’ – so which is best for you?

Think vans, think Ford Transit. It’s a nameplate that has endured 60 years to become synonymous as the van you can trust to get the job done.

The all-electric Ford E-Transit Custom range is set to grow with the addition of an all-wheel drive option from Spring 2026.

If you’re a van driver then chances are you’re spending a lot of your time on the road travelling to various jobs.